Why is Factoring More Favorable in the Current Economic Climate?Ĭurrently, the U.S. Companies with cyclical or seasonal growth spikes.Companies that have questionable earnings trends.

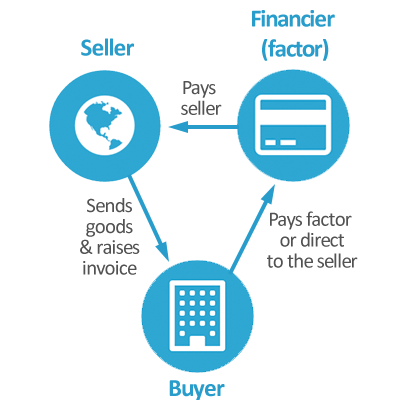

Emerging companies with limited access to capital.Companies needing capital that don’t want to give up equity.Companies that need capital and want to avoid debt.Start-ups that aren’t able to qualify for or receive traditional financing.Elements that make a business a good fit for factoring are: Factoring helps alleviate this burden and allow manufacturers to continue scaling at their desired pace, opposed to scaling as a reaction to their vendors terms. Manufacturing: Most manufacturers receive payment on delivery or on a set of terms. This industry has long payment cycles that can easily put construction companies out of business in the current economic environment. Factoring helps this industry cover these up-front expenditures while providing cash reserves for additional growth of trucks and drivers.Ĭonstruction: The construction industry continues to see rapid growth in housing, medical and commercial facilities and more. Transportation, Freight and Logistics: Transportation costs of buying fuel, paying drivers, covering tolls, and providing insurance must be paid before freight delivery. Access to quick capital helps maintain rapid growth in this industry. Oilfield Services: Maintaining sufficient cash flow, being able to invest in equipment, and hiring qualified talent are pain points of the oilfield services industry. If you are a business owner in one of these areas, reach out to us today to discuss how a relationship with Stellar Bank can guide you through this economy. With Houston being a leader in a few of these areas such as oilfield services, Stellar Bank offers the expertise and factoring these industry leaders need to successfully leverage this financing option. The core industries that use factoring are manufacturing, staffing, oilfield services, construction, wholesalers, distributors, engineering, industrial services and transportation 2. What Industries are a Good Fit for Factoring? Once the invoice is paid, the factor pays the business the remainder collected minus the discount rateįactoring becomes highly beneficial to your business as it provides fast access to cash, cash flow without taking on debt, checks the client’s credit, and relieves the stress of waiting for client-debtors to pay their invoices.

Alternative Financing Options – Is Factoring Right For Your Business?

0 kommentar(er)

0 kommentar(er)